We are committed to sharing news, stories, events and opinions that ensures our province stays free, united and independent from the overreach of the Federal government.

All are welcome and respectful debate is encouraged. Please join with the intention of participating. Proceeds are donated.

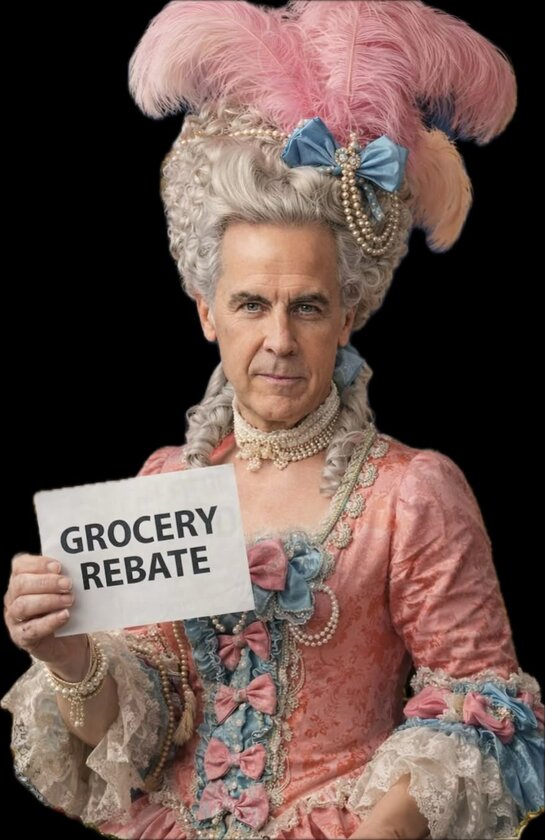

I call BS. Just another way government is controlling you and making you dependent on its largesse.

You want to help people? Quit sending billions of dollars overseas. Cut out that destructive carbon tax so people pay less up front and can look after themselves. I’d bet the savings there alone would be more than the GST handout and EVERYONE would benefit. But noooo, that way, you no longer have control!

Copied ⬇️

The upcoming increase to the GST credit is meant to address rising living costs and is primarily targeted at lower-income Canadians.

Prime Minister Mark Carney this week announced the Canada Groceries and Essentials Benefit which will be sent out to approximately 12 million eligible Canadians for the next five years, beginning this summer.

Here’s a look at what the credit is, who is eligible for the extra rebate, and how much families can expect to receive.

What Is the Credit?

The Canada Groceries and Essentials Benefit is a 25 percent increase in the Goods and Services Tax (GST) credit and will be accompanied by an additional one-time payment this year worth 50 percent of the credit.

Households that meet the eligibility criteria will be granted the one-time 50 percent boost in June, with the 25 percent increase tax credit starting the following month, the prime minister said during his Jan. 26 announcement. The increased credit will arrive every quarter for five years.

Carney said the credits will provide hundreds of additional dollars annually to individuals and families with low to moderate incomes and described the multibillion-dollar credit plan as a bid to alleviate the burden of sales taxes incurred on groceries and household essentials.

Who Is Eligible?

Ottawa has yet to release a formula for assessing eligibility; however, its connection to the GST credit suggests similar criteria will likely be applied.

That means the new benefit will be allocated only to individuals earning below a specific income level. This threshold fluctuates depending on household makeup.

Canadians must be at least 19 years old and a resident of Canada to qualify for the quarterly GST payments. Marital status, number of children, and income are all factors in determining eligibility.

The Canada Revenue Agency (CRA) currently uses the information from a person’s latest tax return to determine if they are eligible for GST and what amount they will receive. Currently, the GST credit begins to decrease once the adjusted family net income exceeds $45,521, according to the CRA.

The income threshold for an individual without children for the 2024 tax year was $56,181. For a single parent with four children it was $74,201.

The limit hits at $59,481 for couples with no children and rises to $63,161 for those with one child. It is $66,841 for couples with two children, $70,521 for those with three kids, and $74,201 for couples with four.

How Much Will You Receive?

An average family of four currently receives roughly $1,100 per year from the GST credit, but Carney said the new credit will increase this amount to an average of $1,890 this year, followed by $1,400 per year for the subsequent four years.

The increased credit will also grant an average of $950 for a qualifying single individual this year and $700 annually for the subsequent four years, in contrast to the existing average sum of $540.

Carney has said those who receive the cheques can use the money however they wish because it’s a “free country,” but added that the goal is to offset grocery costs. He said lower-income Canadians will likely spend it on food because they spend more of their income on essentials such as food and housing than those who earn more.

How and When Will You Receive it?

The government has not announced any application process for the new benefit. Instead, the CRA will automatically issue payment if your tax return indicates eligibility. If you have not filed your tax return, you will not receive the credit.

GST credit payments are issued by the CRA four times a year on the fifth of January, April, July, and October. If these dates fall on a weekend or holiday, payments are sent on the preceding business day.

Aside from the one-time 50 percent boost in June, the 2026 new benefit payment schedule for the remainder of the year will be July 3 and Oct. 5.

A GST payment was already processed on Jan. 5, and a subsequent payment will be made on April 2, prior to the benefit coming into effect.

The Canada Groceries and Essentials Benefit is not law yet, however. It must still be approved in Parliament and receive royal assent.

Conservative Leader Pierre Poilievre has said his party will support the Liberal government’s proposal, which would guarantee passage of the benefit through the House of Commons.

Past Benefits

The Canada Groceries and Essentials Benefit follows on the heels of a one-time extra GST payment to eligible recipients in 2023 by the administration of then-Prime Minister Justin Trudeau.

The Trudeau government in July 2023 issued a one-time rebate to approximately 11 million low- and modest-income residents to help with rising food costs. This payment was equal to double the GST credit amount received in January 2023.

Trudeau also implemented a GST/HST holiday before Christmas in 2024. The tax break between Dec. 14, and Feb. 15 exempted “holiday essentials” such as snacks and prepared foods from GST and HST at the grocery store. Restaurant meals, beer, wine, and certain items for children such as clothing, footwear, diapers, and toys were also tax-free during the two-month period.

Provincial and territorial governments in Canada have also previously offered direct payments and tax cuts to residents.

The Ontario government issued a $200 rebate to all taxpayers in the province to assist with the high cost of living last year. Cheques were issued to the approximately 12.5 million adults who filed a 2023 income tax return as well as to 2.5 million children.

Premier Doug Ford told reporters at the time the government cheques were a bid to offset the “high costs of the federal carbon tax and interest rates.”

Quebec issued a one-time refundable tax credit of $500 as part of its 2022-2023 budget to approximately 6.4 million residents to help with the rising cost of living. This payment was provided to adults with a net income of $100,000 or less, with a partial payment available for those with incomes up to $105,000.

Alberta also offered relief to its residents, but in the form of fuel tax relief. The province suspended its provincial fuel tax starting April 1, 2022, to combat high gas prices. The tax suspension enabled drivers to save 13 cents per litre on gasoline and diesel and was effective throughout 2023. A partial reduction was implemented during the initial three months of 2024, before being restored to full or partially reduced rates, contingent upon oil prices.

The federal and provincial initiatives were designed to provide quick financial relief, though some were criticized for being a bid to buy votes.

Use these discount codes to get 1/2 price subscription.

Monthly FREEALBERTA -$1

Annual GWDISCOUNT- $12