We are committed to sharing news, stories, events and opinions that ensures our province stays free, united and independent from the overreach of the Federal government.

All are welcome and respectful debate is encouraged. Please join with the intention of participating. Proceeds are donated.

https://www.smalldeadanimals.com/2025/01/30/featured-comment-30/

“The only fly in the ointment in step 3 is that CT Carney needs a 2/3 majority vote in parliament to officially declare an emergency. Speculation is that would be difficult, because hopefully the cons won’t fall for it. Then I can imagine the government, and the media, blaming the conservatives for “not putting Canada first!”

We’re done, folks. Unless these stupid Canuckistans finally wake up in time to avoid the trap that’s being laid out for them, we’re going to get spoon-fed socialism for generations to come.”

Use these discount codes to get 1/2 price subscription.

Monthly FREEALBERTA -$1

Annual GWDISCOUNT- $12

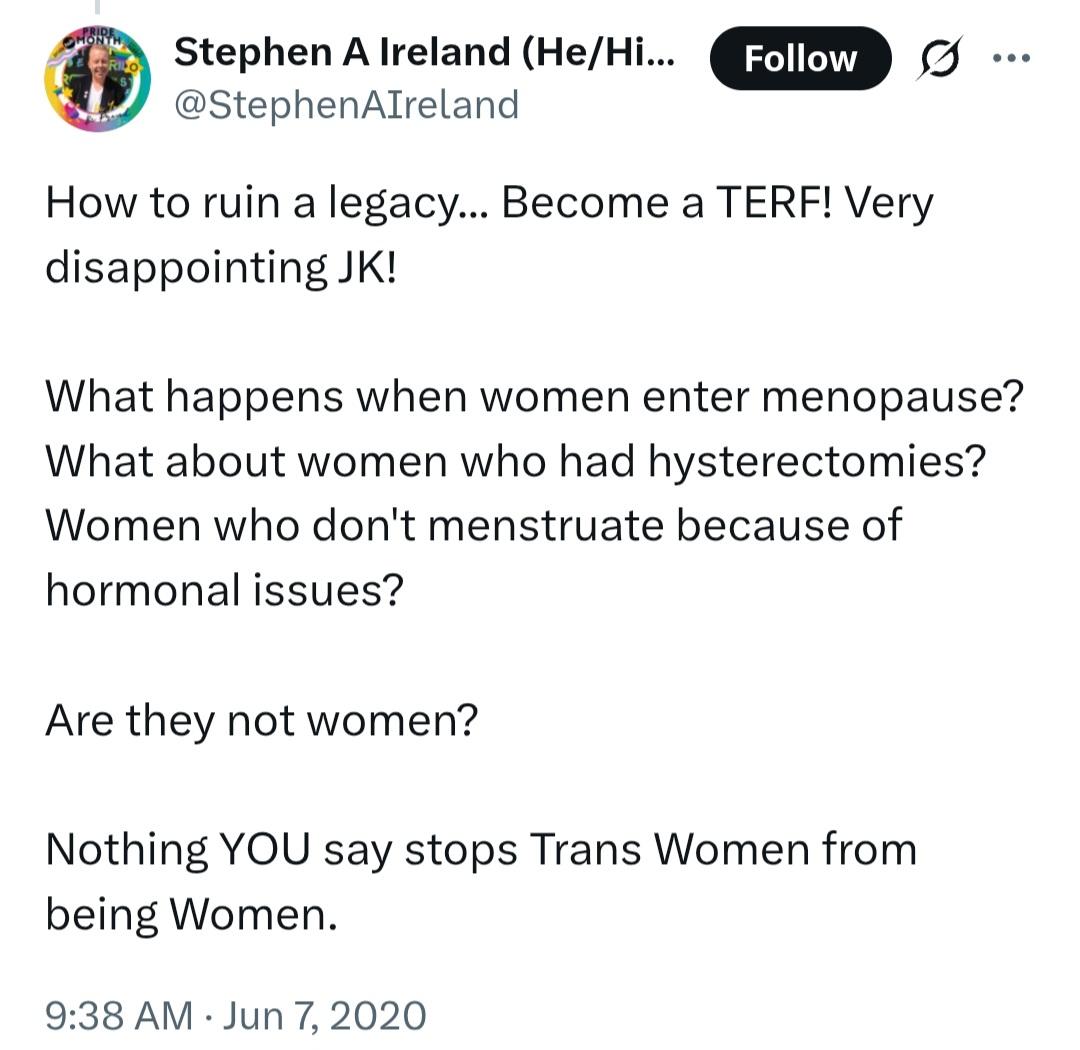

Stephen Ireland pride co-founder sentenced to 30 years for child rape.

Surrey, England

https://x.com/i/status/1939783256620298492